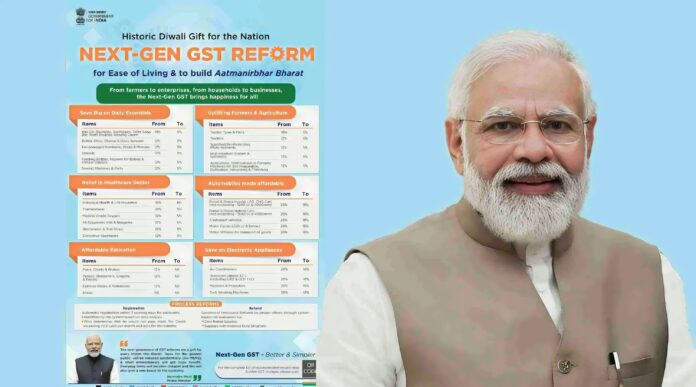

Next-Generation GST: Kam Tax, Zyada Fayda

Is guide me hum step-by-step dekhenge ki nayi GST rates se aam log, farmers, MSMEs aur consumers ko kaise seedha fayda mil raha hai. Neeche har category me Purana Rate → Naya Rate, kisko fayda, aur chhota sa udaharan diya hai.

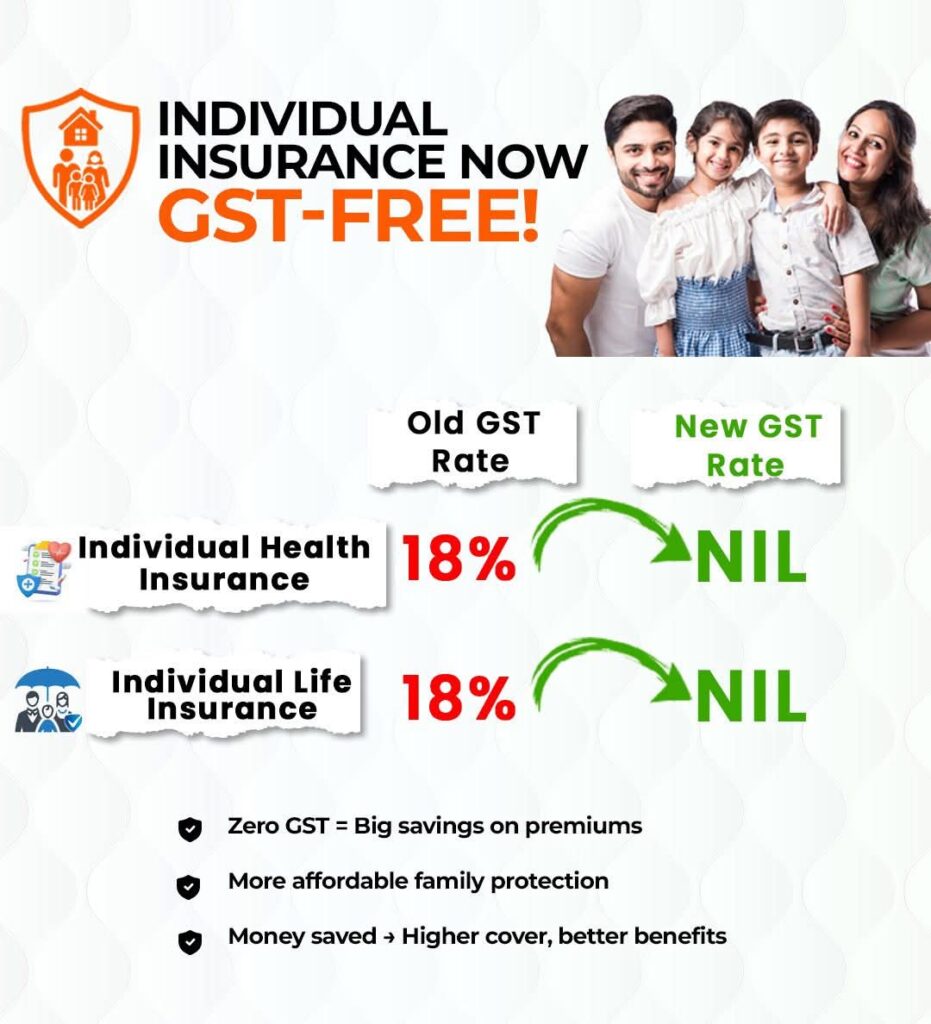

1) Insurance: Personal Health & Life Insurance par GST 18% → NIL

- Kya badla: Individual Health Insurance: 18% → NIL | Individual Life Insurance: 18% → NIL

- Kisko fayda: Family protection ab aur affordable; premium me seedhi bachat.

- Example: Annual premium ₹20,000 tha to pehle GST ₹3,600 (18%) lagta tha. Ab ₹0. Seedhi bachat ₹3,600.

2) Healthcare: Medicines, Devices, Spectacles par GST 12% → 5%

- Drugs & Medicines: 12% → 5%

- Medical Devices: 12% → 5%

- Spectacles & Contact Lenses: 12% → 5%

- Fayda: Treatment cost har step par kam—prescription bill, devices, eyewear sab me relief.

- Example: ₹2,000 ki medicines par pehle GST ₹240 (12%) tha; ab ₹100 (5%). Bachat ₹140.

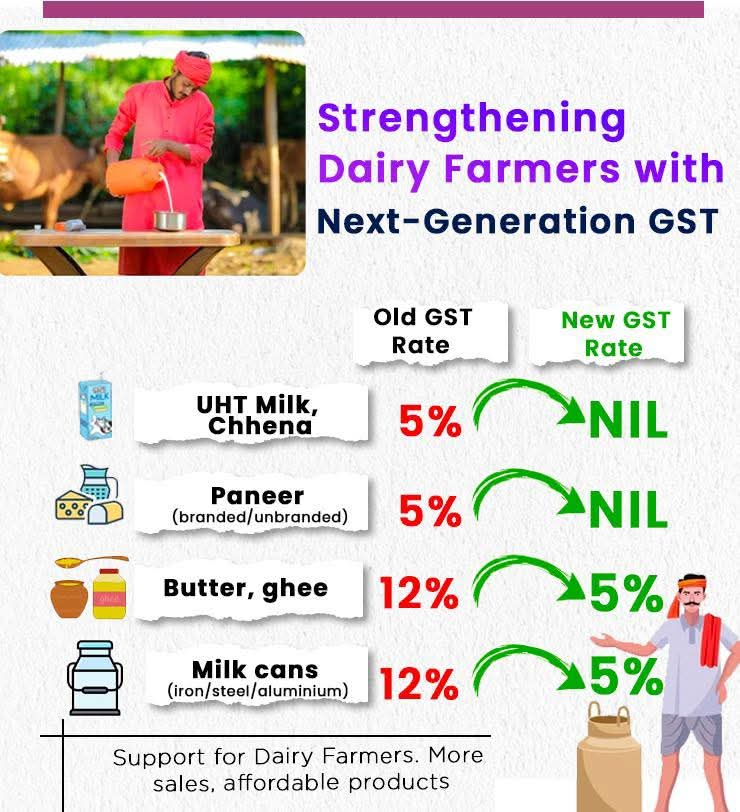

3) Dairy: Doodh & Paneer par NIL, Ghee/Butter & Milk Cans par 12% → 5%

- UHT Milk, Chhena/Chhana: 5% → NIL

- Paneer (branded/unbranded): 5% → NIL

- Butter, Ghee: 12% → 5%

- Milk Cans (iron/steel/aluminium): 12% → 5%

- Example: Paneer ₹300 par pehle ₹15 GST; ab ₹0. Ghee ₹500 par pehle ₹60; ab ₹25. Bachat ₹35.

4) Krishi Sinchai: Drip & Sprinkler Systems par 12% → 5%

- Fayda: Paani bachao tech sasti—pumping kam, bijli bachegi, yield badhegi.

- Example: Drip system ₹1,00,000 par pehle GST ₹12,000; ab ₹5,000. Seedhi bachat ₹7,000.

5) Handicraft & MSME Inputs: 12% → 5%

- Handicraft items: 12% → 5%

- Chamois/Patented/Metallic Leather: 12% → 5%

- Bagasse, Rice Husk Cement, Jute Particle Boards: 12% → 5%

- Fayda: Swadeshi utpaad saste—demand & rozgar dono me boost.

6) Packaging & Supply-Chain: 12% → 5%

- Corrugated/Non-corrugated boxes, Paper pulp trays, Packing paper/cases/crates: 12% → 5%

- Impact: Packing sasti → logistics cost kam → final MRP par pressure kam.

- Example: ₹50 ka carton pehle ₹6 GST; ab ₹2.50. Bachat ₹3.50 per box.

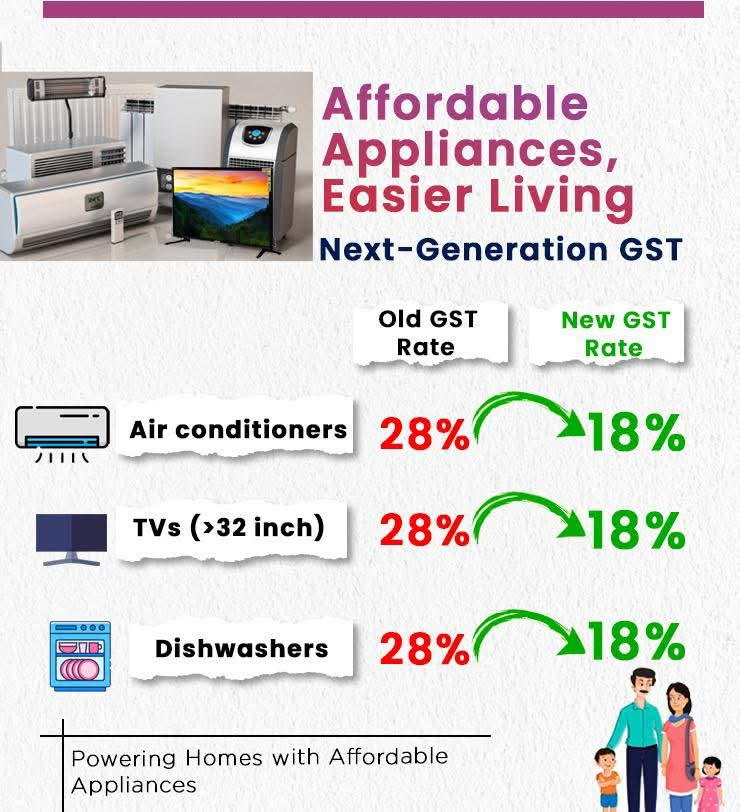

7) Home Appliances: 28% → 18%

- Air Conditioners, TVs (>32″), Dishwashers: 28% → 18%

- Example (AC): Base price ₹40,000. Pehle GST ₹11,200 (28%) → Total ₹51,200. Ab ₹7,200 (18%) → Total ₹47,200. Bachat ₹4,000.

8) Transport & Auto:

- Bicycle: 12% → 5%

- Two-wheeler (bikes >350cc ke alawa): 28% → 18%

- Small Car: 28% → 18%

- Auto Components/Spare Parts: 28% → 18%

- Buses & Trucks: 28% → 18%

- Example (Two-wheeler): ₹1,00,000 par pehle ₹28,000; ab ₹18,000. Bachat ₹10,000 (registration/insurance alag).

Consumer ke liye Quick How-To

- Invoice check: New GST rate bill me properly reflect hona chahiye.

- HSN/SAC verify: Handicraft/leather/packaging me sahi classification confirm karein.

- Insurance quotes refresh: Individual health/life par NIL GST dikhna chahiye.

- Medical bills: Medicines/Devices/Eyewear par 5% ensure karein.

- Big purchases: Base price, GST, aur other charges ka written breakup lein.

FAQ (Short)

Q: Kya sab categories par yehi rate hai?

A: Individual policies/products par above rate lagu; group policies ya specific items me alag ho sakta hai. Always invoice/notification check.

Q: Rate kab se effective?

A: Official notification ke effective date se. Invoice date par jo rate lagega, wahi final hoga.

Summary

- Insurance (Health/Life): 18% → NIL

- Healthcare (Medicines/Devices/Eyewear): 12% → 5%

- Dairy (UHT/Paneer): NIL; Ghee/Butter & Milk Cans: 12% → 5%

- Agriculture Irrigation (Drip/Sprinkler): 12% → 5%

- Handicraft/MSME Inputs & Packaging: 12% → 5%

- Home Appliances & Auto (most): 28% → 18%

Tip: Agar kahin new rate apply na ho raha ho, seller se updated GST notification/HSN mapping dikhane ko bolein.

Nich

[…] Next-Gen GST Reforms 2025: Kam Tax, Zyada Fayda for Farmers, Consumers & MSMEs […]